By Andrej Nosko

That Mr. Hugo Chavez, Venezuelan president, is not too 'fond' of foreign investors is no secret, but that he has a zealous follower in the fastest growing economy of the EU, Slovak Republic, is not that well known. Slovak Prime-minister, Robert Fico is recently gaining attention for his plans of restoring full state control, and ownership over (49% of) previously privatized assets as his way of winning (?) the price war against the partly state-owned gas supplier. The previous government of Mikulas Dzurinda (and Finance Minister Ivan Miklos), has succeeded in putting Slovakia on the global investor map, and provided solid basis for the current economic growth. In 2002, this government has also sold 49% 0f Slovak gas company, SPP - previously integrated (now legally unbundled) to the Slovak Gas Holding B.V., a consortium of Gaz de France and E.ON Ruhrgas. The remaining 51% of SPP's shares are held by the Slovak National Property Fund.

"You have nothing to do with it"

/2008-10-17-telefonat.jpg)

"And Miklos"

"And Dzurinda"

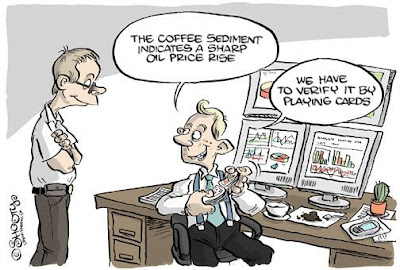

Prime minister Fico, who in line with his political philosophy, has vocally opposed any and all privatization, is now, at least verbally, trying to get hold of the previously privatized assets, and calls for limiting the scope of private entrepreneurship in the country. Be it in the health care, pension, or energy sector. In this post I focus on the case of gas company SPP (although the story of Transpetrol deserves some interest as well). The current Slovak government doesn't believe in markets, and especially not in those in energy sector, and would like to dictate prices, and conduct social welfare policy by digging into the private pockets of foreign investors. To the calls, that prices of gas are into large extent dictated by Russian Gazprom, and SPP has to reflect rising prices on the wolrd markets Fico remains silent. When asked why Fico's government does not negotiate better prices of gas for Slovakia, he only replies that they would be stupid to do so if there are foreign co-owners to cover the costs of subsidizing the prices as well. The above cartoon says it all.

There are following options signalled by Mr. Fico to his co-owners of energy sector companies:

- either the private companies succumb to the political decisions (sometimes conveyed via the energy regulator) to keep their prices artificially low, conduct investments as Fico's government wishes, or

- their assets will be nationalized (threats to, SPP, Enel (EN: subscription required) article in SK), or

- the government changes the law in such a way to get the company to do what they want, or

- they sell their share back to the government (at the price they bought it for 6 years ago)

"Independent" regulator as a means of social policy

The story is not new. Chairman Fico, has been opposing the privatization since it was on the agenda. This is not incongruent with his party line. Since his party SMER got into the government, Fico has been struggling to gain control over the 'monopolies,' and the economy as a whole. The 'independent' regulatory body URSO (Regulatory Office for Network Industries), cannot be any longer seen as independent. To illustrate this point, we can quote the chairman of the regulatory board Jozef Holjencik, and his reaction to the alleged using of the regulator to promote social policy: "simply, it was interest of the state to protect them [households and small companies]. We respect that." That the work of the Slovak regulator is under political pressure was recently pointed out also by Blahoslav Němeček from the Czech regulatory authority during a recent conference in Bratislava.

Fight against 'the bad, bad capitalists' as a political marketing

Fico, was using the anti-capitalist rhetoric of class struggle against the corporations to get elected, and has never approved of the privatization (although very much needed for financing of the economic reforms (he did not approve of those either)). The price war (leaving the question whether he actually means it or its just a strategy of political marketing) of the government and the foreign investors in SPP has had so far three phases:

- Verbal threats of nationalization (August 2008)

- Attempts to change the conditions of privatization contract via change of legislation

- Concurrent Buy-back offer and change of Business Code (November 2008)

Although the foreign investors have minority of shares, at the time of privatization, they were given managerial control over the company - an element that has been a thorn in Fico's side since then - he has attempted to change the business law in order to change the conditions of the privatization contract, since that hasn't work out; he has threatened to expropriate the company, or offered an unrealistic buy-back at previous price (TA3, Téma dňa, 17.10.2008, 19h55) and finally succeeded in changing of the law (TA3, Téma dňa 04.11.2008, 19h55). Previously, an application for price increases to the URSO was a decision of the management. Now the general assembly of all stakeholders has to vote on the decision - thus state (with its 51% of shares) can block such decision.

Mr. Fico's argumentation is quite surprising, according to him (Téma dňa, 17.10.2008, 19h55), companies should follow the political decision of the government, or sell their shares back to the state at the original value (of 2002). Nonetheless, when the reporter asked him how this operation would be financed, prime minister only replied that he, "cannot say how this would be done, since they would do it in a similar way as buying back of Transpetrol (from Yukos Finance), but he cannot share details, in order not to threaten the Transpetrol buy back operation."

It is also important to remind in this context, what will happen according to Russian media (article in Russian, article in Slovak), after Slovak government buys back shares of Transpetrol from Yukos. If the Russian media is better informed, they might be handed to Russia, I have observed this eventuality already at the end of the previous post.

Absolutely surprising is how prime minister Fico, suggests to the co-owners of SPP to cross-subsidize the sales of gas. Pointing out the fact that SPP group is generating profit, nonetheless, he is indirectly hinting that SPP should subsidize the prices for households from the income from the transit-generated profits. The logic of this might be surprising to those in the EU, that are well versed in the Energy legislation. Slovak prime minister, although aware of this, is trying to push SPP to figure out how to bypass the anti cross-subsidization legislation in order to lower the prices for households. In the context, when the chairman of the regulatory board of URSO Jozef Holjencik also thinks that unbundling doesn't solve anything and only leads to higher prices (sic!), this comes at no suprise.

Finally, when a journalist asked, why state doesn't use its dividends (from the 51% shares) to cover for the protection of households, and to conduct the social policy directly, Fico only responded: why should only state cover for the costs of the household subsidies, [...] and if there is a 49% foreign shareholder, [...] they [state] are not stupid to cover it. (sic!)

Read more on Nationalization of energy companies (Slovakia not Venezuela this time)